Homeownership is one of the biggest wealth generators in the United States – but not for Black families.

The Center for NYC Neighborhoods is looking to change that pattern through a pilot program called Generation 2 Generation, focused on Black households in Central Brooklyn and North Bronx. Launched in October as part of the Center’s Black Homeownership Project, it focuses on helping Black homeowners and their families retain and build intergenerational wealth through a combination of education and free estate planning services, aided by local community partners.

“For far too long, a legacy of racist housing practices has made it impossible for many Black families in the city to tap into the equity-building, cross-generational benefits of homeownership,” says Christie Peale, who heads the Center for NYC Neighborhoods. “Inheriting a home does not automatically lead to sustained homeownership — systems must be in place to protect it.”

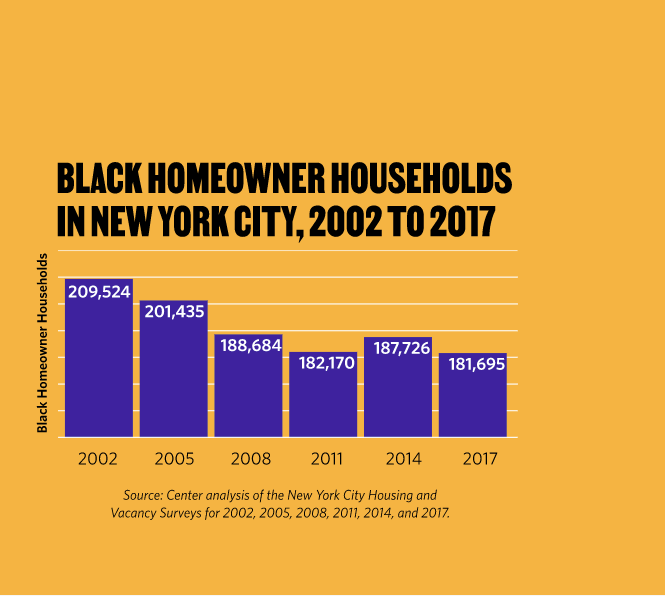

A study published last year by the Center for NYC Neighborhoods found that, in addition to paying higher closing costs (on average, Black homebuyers pay $7,000 more in closing costs) and higher interest rates than White home buyers, the overall share of Black homeowner households in the city has sharply declined in the past 20 years.

(Graphic courtesy Center for NYC Neighborhoods)

Put simply, inheriting a house often does not lead to sustained homeownership for many Black families in New York City.

“Our research and conversations with Black homeowners, landlords, brokers, real estate professionals have shown that the loss of Black homeowners is due to existing structural, racial and intentional discriminatory housing practices and policies that have worked to strip Black households of intergenerational wealth,” says Sabrina Bazile, Senior Program Manager for the Black Homeownership Project.

These systemic inequities, exacerbated through the pandemic, include ongoing discriminatory mortgage lending practices and predatory tax liens, water bills and other charges against homeowners. “These disproportionately occur in Black neighborhoods and allow private investors to profit and target the financial struggles of Black homeowners,” Bazile says.

Black families are often the target of deed theft when scammers take the titles from the homes of the homeowners without their knowing. They also are often priced out of their own communities by speculation and gentrification due to rising property taxes, increased repair costs and an overall lack of affordability that leads to increased housing instability, foreclosure and displacement. All these issues contribute to a stripping of wealth in Black families.

But a lack of affordable estate planning services and a broader skepticism toward the legal system means few Black homeowners actively engage with the estate planning process before an urgent need arises – or before it’s already too late, the program’s developers note.

Through Generation 2 Generation, the Center is currently developing curriculums for estate planning workshops and finding ways to provide free direct services such as legal consultations, writing wills and assets and healthcare proxies.

The workshop curriculums and resources will be passed on to community partners, including government agencies and nonprofits, who can disseminate and embed Generation 2 Generation’s resources to the homeowners they serve. Program leaders are making sure the information is coming from trusted sources such as elected officials and other community boards.

This program will be focused in majority-Black and -Brown neighborhoods that have a history of being redlined by the government and financial institutions. They also prioritize working with Black-led housing counseling and legal service providers who have roots and expertise within their diverse communities in Central Brooklyn and the North Bronx.

“We are working with Caribbean communities, we’re working with other immigrant communities,” Bazile says. “We just want to make sure that the message we’re providing is tailored and is clear and direct.”

JP Morgan Chase is funding the majority of the project, investing $890,000 in G2G as a way to preserve a dwindling source of wealth for New York City’s Black families.

“If you are not able to navigate the system or afford that order, then what happens to the hard work that the family has put into their home?” says Jeanique Druses, the Senior Program Officer and Executive Director for Global Philanthropy at JP Morgan Chase. “The benefit that they thought they were leaving is stolen from the family.”

Druses says the project is a timely attempt to promote inclusive economic growth, spurred on both by the racial justice movement that reignited in 2020 as well as the pandemic’s disproportionate impact on Black families.

“Thinking about generating wealth for the Black community given some of the systematically racist challenges that they’ve faced and have continued to face, this particular innovation was something that was really tangible and could be acted on right away within the context of Covid, where you have many older Black individuals passing away,” says Druses.

In addition to G2G, the Center for NYC Neighborhoods has already launched their owner-landlord program which focuses on providing services for small homeowner landlords with one to four units. This program assists homeowner landlords with assistance from small repairs to foreclosure prevention and Covid assistance.

At the moment, the Center is working on driving awareness about the new resources available to low- and middle-income Black homeowners in the city.

“A big part of what we’re doing by being in the community is to really let others know — not only potential homeowners but our elected officials and others … that there is a resource such as ours that we provide,” says Randy Reed, a program manager at the Center. “It’s okay if you don’t really know what direction to go and know where to start.”

This story has been updated to correct the spelling of Bazile’s last name, and to reflect that the Center for NYC Neighborhood’s study was not funded by JP Morgan Chase.

This article is part of Backyard, a newsletter exploring scalable solutions to make housing fairer, more affordable and more environmentally sustainable. Subscribe to our weekly Backyard newsletter.

Nia Springer-Norris is a Chicago-based solutions and culture journalist who contributes to Next City and Kirkus Reviews. Her work has also been featured in Ms., Romper and Parents.com.