This story was originally published by the Illinois Answers Project and South Side Weekly.

It was early 2020 when Jay Davis realized his family was going to lose his childhood home, a red brick house in Rosemoor on the South Side of Chicago that had been in his family for generations.

Davis’ great-uncle had been living there, and as his dementia worsened the one-story house began to deteriorate. When he died, he left it to his son who had serious health issues and could not maintain the home, Davis said.

Davis, 41, wanted to keep the house from becoming another vacant lot on the South Side. He understood the significance of homeownership as a tool for building generational wealth that has been denied to many Black Chicagoans due to racist practices like redlining and predatory lending.

He experienced this first-hand when he was in his early 20s and made a foray into real estate investment. Davis was the proud new owner of a condo and another property that he planned to rent out when the 2008 financial crisis hit. He wasn’t able to make his mortgage payments – which he said he should have never been approved for – and lost both homes.

With help from Courtney Jones, a real estate developer and leader of the newly established Community Receiver Program, Davis worked to fix up his cousin’s home for resale.

The Community Receiver Program works with Black and brown real estate professionals on the South and West sides to rehabilitate vacant and foreclosed properties.

Typically, receivers are management companies brought in by the courts to address unsafe conditions in buildings that have been neglected before turning them back over to their original owners.

Private, for-profit actors in this space aim to maximize profits and often don’t have much of a stake in the long-term success of the neighborhood. In the past, some companies have used receivership to take ownership of occupied homes through foreclosure when owners could not pay for the cost of repairs, a practice that is now frowned upon by the courts, said Will Edwards, assistant commissioner for neighborhood development and housing preservation in the Department of Housing.

Today, the Department of Housing partners with nonprofit agencies to do this work in a more community-minded way through a program called the Troubled Buildings Initiative, but the need has outpaced the federal funding available to these agencies.

With the Community Receiver Program, Edwards said the city hopes to “right historical wrongs” by playing an active role in training participants to responsibly rehabilitate abandoned properties.

The program works to empower local professionals – brokers, general contractors, mason workers and first-time investors – to reclaim receivership as a tool to uplift themselves and their communities by restoring affordable housing and keeping wealth generated from property sales circulating in the local economy, said Jones, who is executive director of the Black Coalition for Housing, which co-runs the program.

Sometimes they petition to be receivers through the courts, but they also make use of other opportunities and city programs like Chicago Neighborhood Rebuild that help investors acquire, remodel and resell abandoned properties that might otherwise have remained vacant.

Since 2020, the program has trained about 520 people and helped rehabilitate 16 buildings, contributing nearly $4.5 million in restored property value, according to the program’s website.

In Davis’ case, he began working on the Rosemoor home after his cousin voluntarily forfeited ownership to him in 2021. Davis said he paid about $7,500 in fees and unpaid water bills to obtain the house, and made sure his cousin found housing.

With guidance from the Community Receiver Program, he assembled a team and repaired the exterior of the home, replaced the roof and some of the pipes, and remodeled the basement. He sold the house in 2021 to a family friend.

“My whole mission in doing this is really to build up the Black community and provide affordable housing for potential Black homebuyers,” Davis said, “and especially first-time Black homebuyers, so they don’t have to go through what I went through.”

The history of receivership and abandoned buildings in Chicago

As the housing bubble burst in 2008, foreclosures spiked across the city but Black homeowners on the South and West sides were hit particularly hard due to heightened rates of subprime lending in segregated communities, according to a 2018 study published by the University of Illinois Department of Urban and Regional Planning.

While other areas of the city stabilized by 2013, foreclosure rates remain high in communities on the South and West sides, according to data from DePaul University’s Institute for Housing Studies. This has led to the deterioration of smaller rental properties of two to four units, which make up the bulk of Chicago’s affordable housing, said Sarah Duda, the institute’s deputy director.

This contributed to a crisis of vacant lots and the displacement of more than 180,000 Black Chicagoans from 2000 to 2010 and another 75,000 in the subsequent seven years, many of whom left in search of economic opportunity and affordable housing, according to a report from the Great Cities Institute at the University of Illinois at Chicago.

As foreclosures produced distressed and vacant properties, private receivers became more active.

Private receivers oversee the rehabilitation of properties, the cost of which is ultimately paid for by the building’s original owner. If the owner cannot pay back the receiver, the cost becomes a lien – a debt held against the property – and the property may be entered into foreclosure and sold by the receiver, who can keep the profits. Receivers of occupied buildings collect rent on behalf of owners and can raise rents with the permission of the court to help cover repair costs.

It can take months or years for private receivers to fully recover their investment and even then they could potentially lose money, said Anthony Simpkins, president and CEO of Neighborhood Housing Services (NHS) Chicago, a nonprofit that offers loans and other resources to support affordable housing and homeowners in underserved communities.

That’s why private receivers usually only invest in properties that have a strong potential to generate income, he said.

For renters, receivership is an essential tool when they have run out of options to compel their landlords to address poor, unsafe living conditions, said David Wilson, a community organizer with the Metropolitan Tenants Organization, a tenants’ rights advocacy group.

But it comes with a significant risk. Tenants may be evicted when the receiver starts making repairs or displaced later on if the receiver or the building’s owner increases rent, Wilson said.

In an effort to preserve affordable housing and protect residents from displacement, the Department of Housing, through the Troubled Buildings Initiative, works with NHS Chicago and the Community Investment Corporation to provide building owners with resources to try to avoid the need for receivership all together.

When receivership is necessary, the two agencies act as receivers and use federal funding from Community Development Block Grants to cover repairs. This safety net allows them to address the “worst buildings in the poorest neighborhoods” that would not be economically viable for private receivers, Simpkins said.

While owners are still charged the cost of repairs, those who live in their buildings – single-family homes or smaller multi-family homes – can apply for grants to have their debt forgiven over a period of five years, said Edwards, of the Department of Housing.

For owners of larger buildings, they pay back the repairs via repayment plans or otherwise have a lien placed against their property. If they refuse or can’t make payments toward the lien, the property is entered into foreclosure and sold to a new owner, oftentimes a bank.

As long as there is public money invested in a building through a lien or grant agreement, the Troubled Buildings Initiative restricts the rental price of units to rates that would be affordable to those who make 80% of the city’s area median income (AMI).

Critics say this restriction doesn’t do much to ensure housing remains affordable because low-income neighborhoods have a much lower median income than the city’s AMI, which includes surrounding suburbs.

South Shore’s area median income, for example, is less than half of the citywide median income, according to the Chicago Metropolitan Agency for Planning.

“When we do affordable housing, the question is affordable to who?” said Dixon Romeo, executive director of Not Me We, a community organization that fights gentrification in South Shore.

Using receivership in a new way

The Community Receiver Program brings together city, experts and nonprofit resources to train participants on how they might use receivership in a new way – often approaching the process as developers rather than temporary managers of properties, said Sanina Ellison Jones, president of the Dearborn Realtist Board, a trade association for Black real estate professionals that co-runs the program.

Instead of focusing solely on addressing unsafe living conditions, the Community Receiver Program seeks to fully renovate buildings and resell properties to local homebuyers of color or rent them out at affordable rates.

Program organizers want to avoid turning properties back over to negligent owners – which is one way that both nonprofit and for-profit receivers have failed Black and brown communities in the past, Ellison Jones said.

“There was this cycle that we noticed that was continuing, which impacted the residents of the community,” she said.

Courtney Jones, who is married to Ellison Jones, said instructors strive to create a culture that uplifts the surrounding community as well as the investor. The fact that community receivers take on properties in their own backyards naturally pushes them to be better actors, he said.

“If you’re living in that community, how you manage that project is going to impact your own real estate,” he said.

Receivership training is free for participants and run by volunteers from city departments, the city’s two nonprofit lenders and the Dearborn Realtist Board. Community receivers are assigned mentors and work in pods, learning from their peers.

Over the course of the program, participants learn how to acquire and rehabilitate neglected buildings and how to leverage grants or city programs to help obtain those properties.

“Often the value of the property is actually less than the cost to rehabilitate it,” NHS Chicago’s Simpkins explained. “So they can then come to us and get grants toward the acquisition and closing costs to make that project feasible.”

Beyond petitioning for receivership through the courts, community receivers can also acquire vacant buildings through the Cook County Land Bank Authority, which has partnered with the program to hear project presentations from graduating students.

In this way, community receivers – much like public receivers – are empowered to fix up properties that would not normally receive attention from developers and sell those homes for affordable rates while still turning a profit, Jones said.

Jones said he hopes to continue expanding the network of graduates so that the Troubled Buildings Initiative can tap them whenever it needs work done on buildings, even if it is a smaller job like repairing a roof or fixing a boiler.

What’s next for the community receiver program?

Many graduates of the Community Receiver Program struggle to file their first petition for receivership because of the financial risk associated with taking on this kind of project, Ellison Jones said. Moving forward, she hopes to continue to partner with the land bank and with entities like the Chicago Community Loan Fund to get more financial backing for graduates.

Eventually, this might also allow community receivers to be assigned to larger, multi-family buildings, Courtney Jones said. Currently, the program is focused on single-family homes and smaller rental buildings.

The city will continue doing what it can to reduce barriers for community receivers and connect them with opportunities for monetary support, Edwards said. An ordinance passed last year by the City Council allows city debt to be waived on vacant or abandoned properties in low- to moderate-income neighborhoods for those looking to rehabilitate them.

Simpkins said there is always a need for more federal funding to support grant and loan programs that NHS Chicago helps facilitate for community receivers and homeowners. NHS Chicago had to stop accepting new applications for those programs in August due to budget constraints, he said.

The Community Receiver Program is “an important aspect of the [Troubled Buildings Initiative] process that I think is not being utilized enough,” Simpkins said.

But it’s just one small piece in the puzzle of bringing about a reality where housing is regarded as a human right and where public policy affirms that, said Romeo whose organization, Not Me We, serves residents in South Shore and the surrounding area.

While Romeo understands the intention behind an initiative like the Community Receiver Program, he said the city needs to do more to safeguard affordable housing and address its history of discriminatory housing practices – to get at the root of the problem.

“The reality is, it’s one program that’s got a pretty limited scope,” he said, adding that residents also need rent control, more paths to homeownership and additional rental vouchers. “We need all these things at once.”

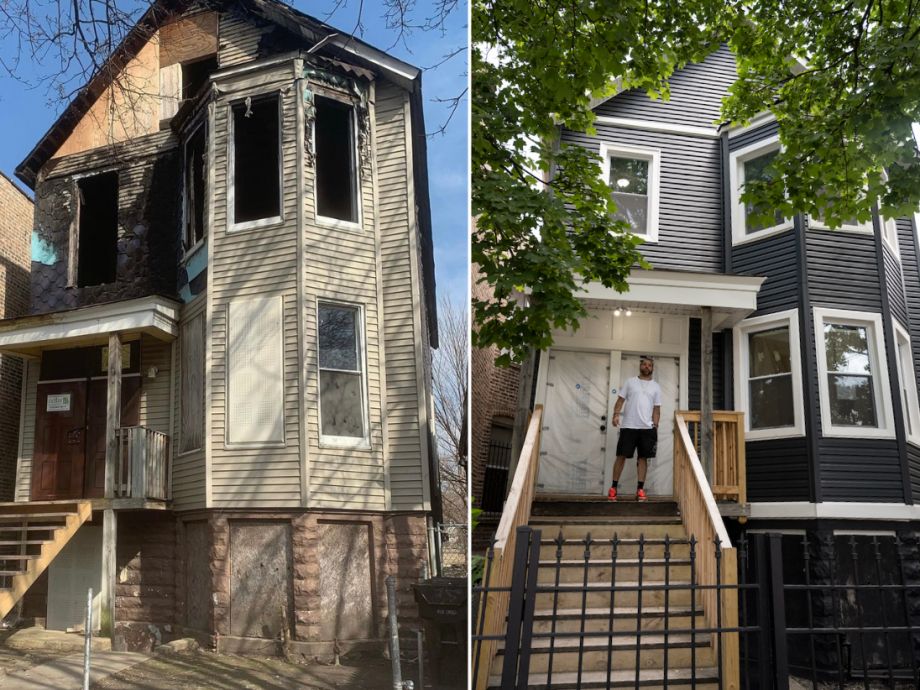

The Rosemoor Home

When it came time to sell the Rosemoor home, Davis wasn’t out to turn a huge profit, he said. He invested $75,000 in remodeling the home and sold it to his best friend’s younger brother, LaMarr Brown, for $150,000 in August of 2021, Davis said.

“Now, my little brother is a homeowner,” Davis said. “… I’m very proud of him.”

Brown smiled as he stood outside of his home with his 10-week-old son, LaMarr Junior, on a sunny afternoon earlier this year. After completing his service with the U.S. Military in 2020, Brown said he was glad to buy his first home from someone he knew he could trust.

After graduating from the Community Receiver Program, Davis purchased an Englewood property from the land bank through Chicago Neighborhood Rebuild, a program in which developers can get loans to rehabilitate vacant homes in Englewood, Garfield Park and Humboldt Park.

“It feels pretty great to be a homeowner because I basically went from barracks to barracks, so I never really lived in a home other than when I was a child,” Brown said.

Davis placed the Englewood home on the market in September.

Now, he’s looking for a property on the South Side to take another shot at petitioning for receivership through the courts. He plans to continue this work of fixing up run-down buildings to support homeownership in his community.

This article is part of Backyard, a newsletter exploring scalable solutions to make housing fairer, more affordable and more environmentally sustainable. Subscribe to our weekly Backyard newsletter.

Kelli Duncan was an investigative reporting intern with the Illinois Answers Project in 2022 and 2023.

Add to the Discussion

Next City sustaining members can comment on our stories. Keep the discussion going! Join our community of engaged members by donating today.

Already a sustaining member? Login here.