The University of Hawai’i Federal Credit Union (UHFCU) was struggling to connect with younger customers in 2020. Without their usual on-campus financial literacy workshops, they knew that they needed digital options to bring this education to engage their younger clients. But how?

But then UHFCU discovered Zogo, an app that gamifies financial literacy. Zogo has partnered with many credit unions and CDFIs — most recently Alltru Credit Union in Missouri — to help them connect with Gen Z.

Credit unions pay a licensing fee for a co-branded Zogo app and push it out to their members. UHFCU found that nearly 300 of their users referred the app to their friends.

“We wanted something that would excite students and motivate them to learn, rather than having material fed to them in a typical classroom setting,” Bari Carroll, UHFCU’s senior vice president of image and experience, said in a Zogo case study.

Zogo was founded and built by Gen Z college students out of their own frustrations with financial education options, so they understand what these young customers want.

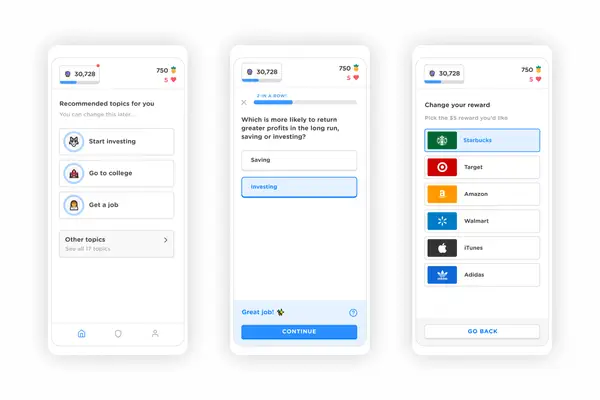

Zogo contains over 400 bite-sized modules addressing topics ranging from how to open a checking account to cryptocurrency and being a low-income student. It also gamifies the learning by allowing users to incur points that can be cashed in for $5 gift cards. So far, it seems to be working. Zogo marketing manager Sydney Mayer says that 96% of Zogo users report improving their financial literacy after using the app.

(Photo courtesy of Zogo) That’s true for Dante Scornaienchi. The 26-year-old initially downloaded the app when the fintech company he works at licensed it for their employees, but quickly became a “super user” who logs in on his own time. “Instead of sitting down and scrolling on Instagram, I fire up Zogo,” he says. “I fell in love with the app because it goes a lot deeper than I initially expected, which is what keeps me going with it.” That kind of engagement with financial education is rare, and has attracted the attention of big banks in addition to CDFIs and other credit unions. Amex and U.S. Bank are now two of the 240 financial institutions to partner with Zogo. Mayer says that she’s seeing a shift in big banks, who are beginning to prioritize environmental, social and governance (ESG) issues. Out of $46.6 trillion managed by financial firms in the United States, an estimated $11.6 trillion are invested using some kind of ESG investment approach, according to US SIF: The Forum for Sustainable and Responsible Investment, a trade organization for ESG investors. That’s up from just $3 trillion a decade ago. One of the ESG issues banks are targeting is access to financial education — particularly for more marginalized communities. Amex and Zogo are building out a module about being a Black entrepreneur, and other projects are on the horizon. “I think education is intentionally not offered as a way to gatekeep. And Zogo is passionate about bridging that gap,” Mayer says. “Now that financial institutions like Amex and U.S. Bank care about ESG factors for their community, that’s something we can really get involved in.” This story is part of our series, CDFI Futures, which explores the community development finance industry through the lenses of equity, public policy and inclusive community development. The series is generously supported by Partners for the Common Good. Sign up for PCG’s CapNexus newsletter at capnexus.org.

Sabina Wex is a writer and podcast producer in Toronto.