A Possible Land Value Tax in Detroit

Detroit lawmakers are weighing a possible land value tax which could take some of the tax burden off homeowners and incentivize new housing, the Wall Street Journal reports. The tax would be assessed on the underlying land, rather than on buildings, potentially prompting owners of vacant land to either sell off their property or begin new construction.

The measure would still need to be approved by the state and would need to pass as a ballot measure, according to WSJ. But one researcher found that switching to a land value tax would lead 95% of homeowners to see their property taxes decline. It could also address vacant land being held fallow by out of state investors who are waiting for the value to rise, per the Journal.

According to a 2021 writeup by NYU’s Shack Institute of Real Estate, “The current property tax system in effect subsidizes owners who sit on their property while drastically increasing the tax burden on those who choose to make improvements.”

The potential move comes as Black homeowners in Detroit have been criticizing the city for overestimating their property tax bills, according to WDET. Overtaxing happens when an assessor values a property higher than what it would actually be valued on the market, leaving property owners with a high tax bill and without the equity to pay for it. A 2020 Detroit News investigation found that residents were overtaxed by about $600 million since the Great Recession. About one in three homes in Detroit have fallen into foreclosure since the Great Recession, partially due to overtaxing, per WDET. The city also increased its property tax rate over the course of decades to make up for revenue lost from population decline.

According to The Detroit News, “City Hall completed a state-ordered reappraisal of every residential property in 2017 to correct the problem, but the pain of its past mistakes remains with thousands who today face foreclosure over back taxes.” The report said that 90% of homes with delinquent debt in the city had been overtaxed.

Pittsburgh initiated a land value tax in 1979, which was followed by a 70% increase in new construction in the next decade – although economists cautioned that they couldn’t conclusively prove this was a result of the tax – ProPublica reports. Neighborhood inequity remained.

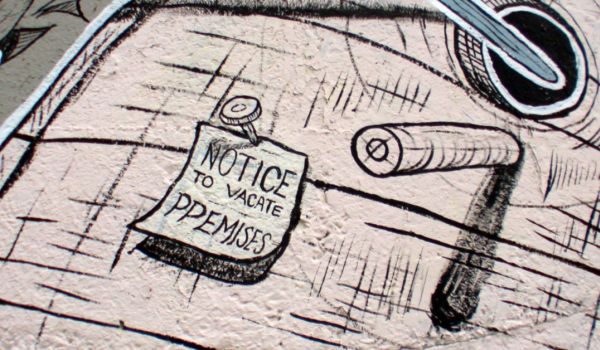

Good Cause Could Pass In New York This Year

New York State housing advocates and lawmakers are confident that some version of Good Cause eviction will pass this legislative session, according to City & State New York. Good Cause, also called Just Cause in other jurisdictions, restrict the reasons that a landlord can evict a tenant so that the tenant can’t be evicted arbitrarily or as a pretext to raise rents.

New York’s legislation is opposed by the landlord lobby, who are particularly riled by a provision that would restrict lease non-renewals due to “unconscionable” rent increases. That provision would essentially be a form of rent regulation that would cover every residential unit in the state.

Gov. Hochul is likely to support some version of Good Cause legislation, in exchange for support for a real estate tax break that she is depending on to boost the state’s housing supply, City & State reports. The tax break would replace 421-A, a controversial tax break that housing advocates said disproportionately produced high-end housing and led to little affordable housing.

Community Land Trust In Houston Sees Funding Halved

A four-year old community land trust initiative in Houston originally funded at $52 million saw its funding cut in half by the city council last month, according to a report from The Texas Tribune and New York Times. Detroit Mayor Sylvester Turner said the land trust can apply for more money once it runs out of cash, which the land trust estimates will happen by spring. The trust was not meeting its ambitious goals, Mayor Turner and city leaders said, owning only 136 homes – far short of the 1,100 homes it was meant to acquire within 5 years.

But the problem is partly a result of poor contracting by the city, according to Times and Tribune, as the city funded only 59 of a promised 240 new homes. Many of the homes it built suffered from poor quality and workmanship.

Other stories we’re following

-

In Virginia, Richmond City Council has approved a resolution that “would essentially require landlords to pass building inspections in order to do business,” according to WTVR.

-

Allegheny County, Pennsylvania “will provide a one-time payment of $2,000 to landlords willing to rent apartment units to people transitioning out of shelters,” according to Public Source.

This article is part of Backyard, a newsletter exploring scalable solutions to make housing fairer, more affordable and more environmentally sustainable. Subscribe to our weekly Backyard newsletter.

Roshan Abraham is Next City's housing correspondent and a former Equitable Cities fellow. He is based in Queens. Follow him on Twitter at @roshantone.