Local economy advocate Stacy Mitchell saw reports about how the Small Business Administration’s Paycheck Protection Program was reaching a greater share of businesses and employees in Great Plains and some midwestern states. Many speculated the pattern was somehow politically motivated.

As co-director of the Institute for Local Self-Reliance, a nonprofit research group, Mitchell suspected the pattern was indicative of something else.

“I just remembered looking at the map and thinking well, this is where community banks are,” Mitchell says.

Small lenders pushed their limits and initially outperformed large lenders — according to the SBA, in round 1, lenders with less than $10 billion in assets accounted for 60 percent of PPP loans, and lenders with less than $1 billion in assets accounted for one-fifth of all PPP loan dollars disbursed. The big banks finally caught up in round 2, making two-thirds of PPP round 2 loans so far. So far, according to a report from the SBA’s Office of Inspector General, the Paycheck Protection Program has not prioritized underserved and rural markets as directed by the CARES Act legislation that created the program.

When she went to crunch the numbers, it was no surprise to Mitchell that the states where community banks have a higher market share of deposits have also seen the most Paycheck Protection Program loans relative to their population size. According to her resulting report, leading the nation on both measures was North Dakota — where community banks have an edge over every other state in the country thanks to the state-owned Bank of North Dakota’s unique model of supporting community lenders from behind the scenes.

“It’s a compelling case study of how the banking system functions,” Mitchell says. “It turns out community banks did a good job, but they have shrunk as a sector.”

As scandalous as it seems that publicly traded companies have gotten aid intended for small business, that’s relatively small compared to the dramatic disappearance of community banks across the country.

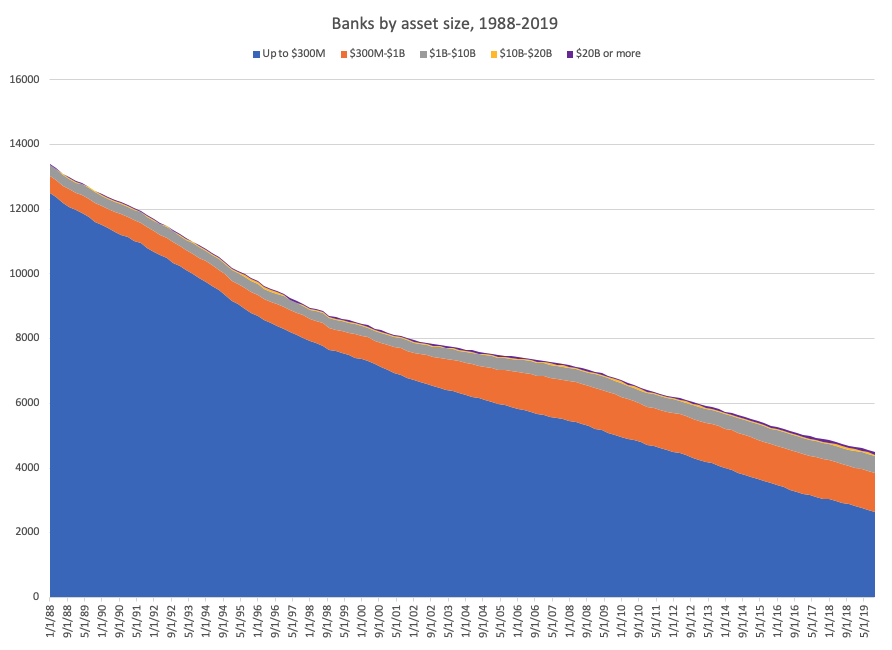

From the 1930s to the 1980s, the number of banks in the U.S. floated between 13,000 to 14,000 — and nearly all of them were very small. As of 1988, there were still more than 12,000 banks with up to $300 million in assets, but today there are fewer than 3,000. Meanwhile, compared to thirty years ago, there are nearly five times as many banks with $20 billion or more in assets.

(Data: Federal Reserve. Chart: Oscar Perry Abello)

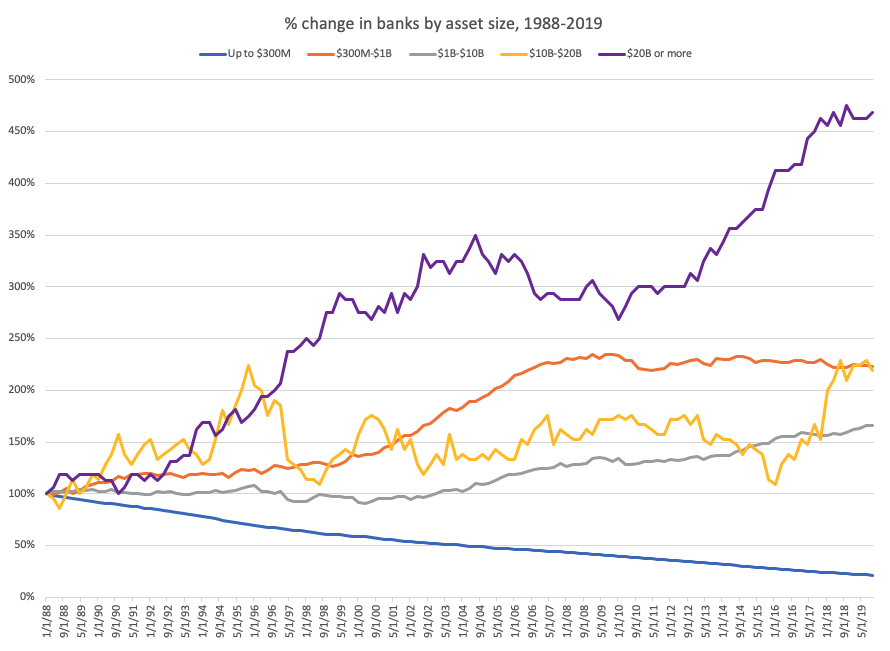

Since small banks still outnumber big banks, the purple band representing the biggest banks is nearly invisible on the chart above. But in relative terms, the biggest banks have grown much faster than any other segment of the banking sector. The smallest banks are the only segment that is smaller than it was in 1988.

(Data: Federal Reserve. Chart: Oscar Perry Abello)

With fewer community banks around, it’s obvious to Mitchell why small business loans have been falling in both dollar amounts and as a percentage of all loans. The COVID-19 pandemic and the PPP program have simply blown the lid wide open on the net effect of the slow but steady disappearance of smaller lenders over the past few decades.

“As with every other part of society, the pandemic has really exposed the weaknesses in our institutions,” Mitchell says. “Small businesses are facing a life-threatening event, and as it turns out not having a banking system that can actually respond to the needs of local economies is a huge liability in a crisis like this.”

There may or may not be any malicious intent behind big banks’ reluctance to fund small businesses compared with their smaller peers. But there are structural reasons why big banks have relatively less incentive than community banks to meet the credit needs of small businesses or other smaller borrowers for that matter.

Larger banks can make larger loans to businesses, and larger loans earn more in interest for a bank while costing the same amount of staff resources to underwrite as smaller loans. That means a bigger bank has less incentive to make the smaller loan sizes that many small businesses need.

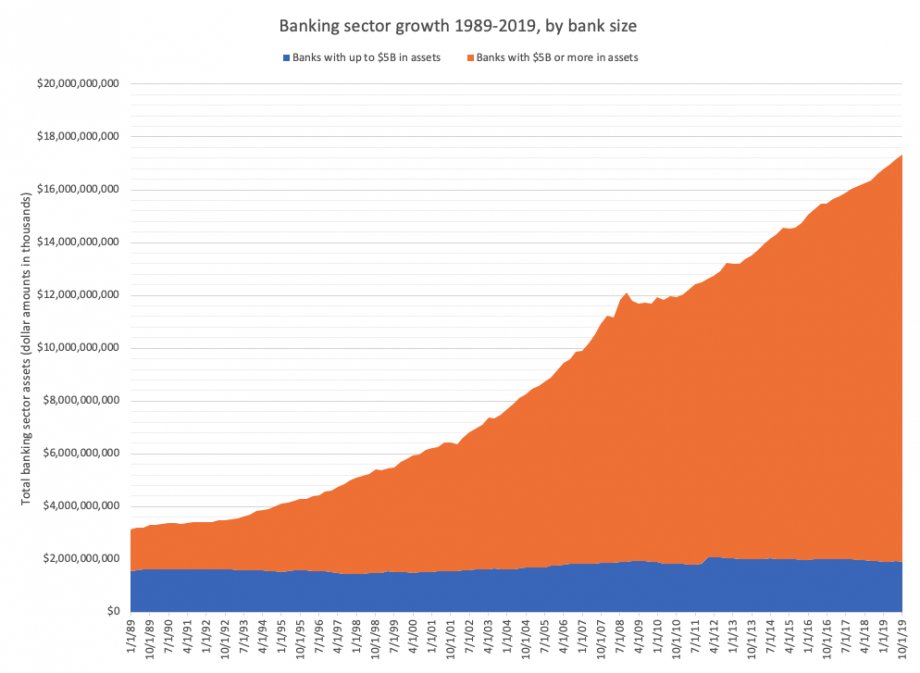

And big banks haven’t just grown in number, they’ve also grown in size. In fact, all the growth in the banking industry since the 1980s has been among banks with $5 billion or more in assets.

(Data: Federal Reserve. Chart: Oscar Perry Abello)

Eventually, the bigger a bank gets, the less interested it gets in making loans. Mitchell explains that as a bank grows, it eventually starts to shift its business model to rely less on income from interest on loans and more on other income from fees or from investments in stocks, bonds or other more exotic assets. The investment arm of the bank can start to overwhelm the rest. More exotic investments promise higher returns and therefore higher profits for shareholders, but community banks generally can’t afford the high-salaried financial analysts that can manage those kinds of investment decisions.

It’s hard to really know when a bank hits that tipping point and shifts its orientation from lending to investing, Mitchell says.

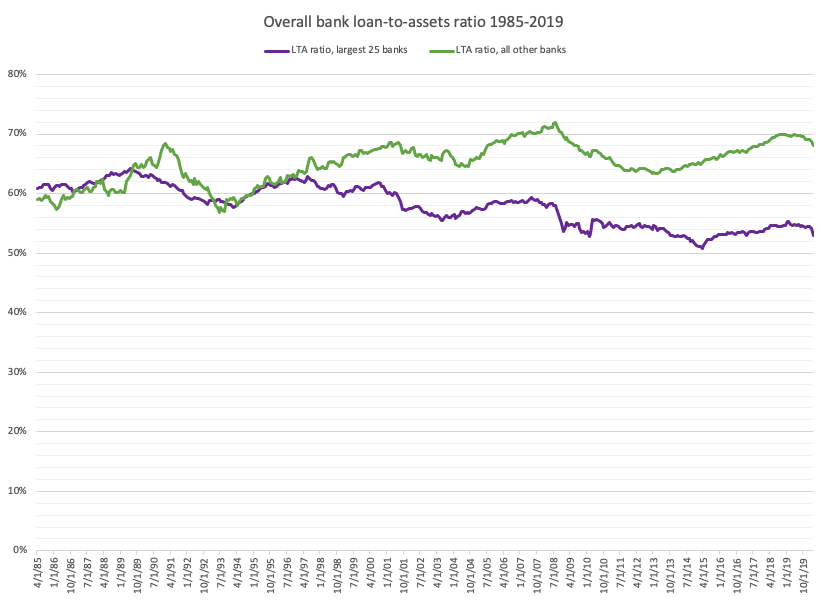

But you can see it in the data.

Federal regulators keep close tabs on each bank’s finances, using what’s known among banks as quarterly “call reports.” The reports are publicly available, through the online database of the Federal Financial Institutions Examination Council. Using that data, you can see each bank’s ratio of loans to overall assets, showing how much it depends on loans versus other investments.

In the 1980s and early 1990s, big banks and other banks had similar loan-to-asset ratios, but in the latter half of the 1990s, big banks started acquiring other banks and growing much more rapidly compared with community banks. Subsequently, big bank loan-to-asset ratios started to dip. The investment arms of big banks came to drive more and more of each big bank’s business model, and lending became more and more of an afterthought.

“The problem with the big banks isn’t just that they’re too big to fail, they’re also too big to succeed at what we need banks to do,” Mitchell says.

(Data: Federal Financial Institutions Examination Council. Chart: Oscar Perry Abello)

The reasons for big banks’ rapid growth and the decline of smaller banks are many, including technology and economies of scale. But Mitchell points to public policy above all as the main driver of the dramatic change in the banking sector over the past three decades.

Before the 1980s, public policy at federal as well as state levels was tilted much more in favor of smaller banks. The first line of a Federal Reserve research paper from 1932 reads, “Public policy in the United States has been opposed to centralization of the control of banking resources.”

That paper quotes a statement from Franklin MacVeigh, who in 1911 as Secretary of the Treasury wrote, “Now is the time to protect for the future the independence and individuality of the banks, and to forestall in their case the general tendency to formation of undue combinations and trust. The prohibition should be so explicit that its spirit as well as its letter could be enforced.”

The research that went into that paper went on to inform the Glass-Steagall Act of 1933, which contained several measures meant to support and encourage small banks. That included creating the FDIC, whose deposit insurance helps smaller banks attract deposits. It also contained the famous provision that separated commercial and investment banking, which was a direct response to the stock market crash that led to the Great Depression.

Big banks have long fought against regulations, arguing that people and communities would be served better through larger, more efficient banks. In 1927, Congress passed the McFadden Act, which loosened federal restrictions on opening bank branches. But that prompted states to respond with their own restrictions. Some states banned banks from opening any branches at all if they weren’t also headquartered in the state.

As with many industries, the move toward deregulation for banks started in the 1980s. By 1990, 46 states had made changes in the preceding decade to reduce barriers for banks to operate across state lines. And that was just the prelude.

In 1994, President Bill Clinton signed the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994, which removed many of the remaining federal restrictions on banking across state lines. The law went into effect in phases over the next three years. Big banks would then unleash themselves across the nation.

You can see it in the data. In the late 1980s and first half of the 1990s, big and medium-sized banks were both growing, opening up branches across state lines and swallowing up small banks as states removed restrictions. Once the federal restrictions went away in the mid 1990s, the number of mid-sized banks took a tumble as they merged with each other or big banks acquired them over the second half of the 1990s. Only recently have mid-sized banks begun growing in number again, as smaller banks either grew or merged with each other to become medium-sized banks.

If there was a nail in the coffin, it was the 1999 Gramm-Leach-Bliley Act, which repealed the Glass-Steagall separation of commercial and investment banking. Some big banks merged directly with investment banks after Gramm-Leach-Bliley, like Chase Manhattan merging with JPMorgan to become JPMorgan Chase in 2000, or Bank of America merging with Merrill Lynch in 2008.

The number of big banks actually fell for several years after Gramm-Leach-Bliley, as they started merging with each other. After a decade of each bank going on a buying spree, acquiring regional and state banks across the country, Wachovia acquired First Union in 2001 — and then Wachovia merged with Wells Fargo in 2008.

Mitchell’s wish list for a return to a more local banking system begins with restoring the separation between commercial and investment banking. “We have to get big banks to spin off their investment arms,” Mitchell says.

Whether it’s done at the federal level or state level, Mitchell would also like to see caps on market shares of deposits that any one bank can have in any one state.

According to FDIC data, in Great Plains states, big banks and community banks have similar market shares per bank, with no one really dominating. Meanwhile in New York, JPMorgan Chase has a 32 percent market share and no other bank has more than 8 percent; in California, Bank of America, Wells Fargo and JPMorgan Chase together have a 50 percent market share and no other bank has more than a 6 percent market share.

Caps on bank market shares aren’t so farfetched. They are technically present in the Riegle-Neal Act of 1994, which says one bank cannot control more than 10 percent of the nation’s total deposits, or 30 percent of any single state’s total deposits unless a state elected to establish its own deposit cap.

Mitchell also points to the need for more regulation of “shadow banks” — brokers, clearinghouses, funds, investment trusts and other financial vehicles that are already larger as an industry than banks, with $52 trillion in assets compared with just $17 trillion for banks. Shadow banks have grown significantly since the 2008-2009 financial crisis.

Historically, as chronicled in Mehrsa Baradaran’s “How the Other Half Banks,” the rise of shadow banks in the 1980s gave banking lobbyists an excuse to argue for deregulation, as they argued it would allow banks to compete with shadow banks.

“The fork in the road was do we look at shadow banks and say you guys are becoming a critical part of the financial system should we regulate you like the rest of the banks or should we let the banking system go,” Mitchell says. “We chose the latter.”

Mitchell recommends revisiting that fork in the road. In her view, it would give all banks, not just small banks, more of an equal footing to compete with shadow banks. Everyone from shadow banks to big banks to small banks would have more restrictions on what they can do as lenders.

Regulatory disclosure burdens are also a factor. Since Congress passed the Dodd-Frank Act during the Great Recession, Mitchell explains that while banks have fewer restrictions on the kinds of activities they can do, they have many more disclosure requirements — putting a tremendous burden on community banks.

“While Dodd-Frank did some good things like establishing the Consumer Financial Protection Bureau, it also structured the banking system,” Mitchell says. “Instead of saying here are some things you can’t do as banks, it said we’re going to let you do more things but we’ll also keep an eye on more things. Big banks have entire floors of lawyers and other people who can deal with that regulatory complexity. Community banks don’t.”

Restoring bank regulations that emphasize limitations as opposed to disclosures might also help with the last piece the Mitchell would like to see — the resumption of more communities starting their own banks, which used to be a much more common occurrence. “We need to make sure we’re creating new banks,” she says. “It flatlined for years.”

Some of that, she says, also has to do with higher requirements for capital to open and sustain a bank today.

From 2001-2009, the FDIC granted approval for more than a thousand banks. But from 2010 to 2018, the FDIC granted approval for just nineteen banks, and in four of those years zero new banks were chartered across the country.

“If you shifted more assets into community banks, how much capital would be available for small business or for that matter homeownership and other community needs? My guess is probably a lot,” Mitchell says.

This article is part of The Bottom Line, a series exploring scalable solutions for problems related to affordability, inclusive economic growth and access to capital. Click here to subscribe to our Bottom Line newsletter.

Oscar is Next City's senior economic justice correspondent. He previously served as Next City’s editor from 2018-2019, and was a Next City Equitable Cities Fellow from 2015-2016. Since 2011, Oscar has covered community development finance, community banking, impact investing, economic development, housing and more for media outlets such as Shelterforce, B Magazine, Impact Alpha and Fast Company.

Follow Oscar .(JavaScript must be enabled to view this email address)

_600_350_80_s_c1.JPG)