Buzz is building around converting offices into apartment buildings — and for good reason. These conversions can play a part in addressing three pressing urban challenges: a lack of housing, an oversupply of office space and the imperative to reduce greenhouse gas emissions.

It’s time for cities to rethink how they use space, as the demand for commercial office space is expected to remain weak. Office cash flows declined by 17.4 percentage points nationwide between the end of 2019 and the end of 2022, and vacancy rates hit 40-year highs in many cities. Vacant offices threaten the vitality of cities too, as they come with negative externalities — in terms of foot traffic, retail sales, financial sector fragility, tax revenues and public goods and services — which risk triggering an urban doom loop.

At the same time, the U.S. housing crisis continues to strain households. The average renter spends at least 30% of their income on rent. Cities lack the appropriate supply of housing, especially affordable housing, to meet the challenge.

Conversions can also play a part in climate change mitigation. Buildings account for 29% of all U.S. greenhouse gas emissions. Converting office buildings – particularly older, less environmentally-friendly office buildings – into apartments is generally a more responsible option for the climate, rather than razing buildings and rebuilding from scratch.

Converting office buildings into greener apartments is a strategy aimed at addressing all three challenges. That’s not to say it’s an easy solution or that every office should be converted. The building must be suitable, the zoning and building codes must permit the conversion, and the financial return has to compensate investors for the risk they are taking.

In a recent policy proposal, we lay out a set of criteria to identify commercial office properties that are suitable for conversion and determine that about 9% of U.S. office properties meet those criteria. Our financial calculator allows users to drill down into which conversion projects would be financially viable by inputting characteristics of conversion projects in major U.S. cities.

There are barriers to converting offices into apartments, particularly green and affordable apartments. But cities can lower these barriers by using both the financial and regulatory tools at their disposal.

Making green office-to-apartment conversions financially viable

Some conversions — particularly those creating affordable housing units — will require subsidies to be financially viable. Property tax abatements and subsidized debt finance are two other crucial policy levers to make office conversions financially viable.

Cities might have only limited resources for office conversion subsidies, especially given the decline in property values and property tax revenues from urban offices and retail. But our calculations show that local governments will eventually see increased property tax revenues from office conversions.

From the local government’s perspective, an office conversion is an investment in future tax revenue. If this incremental tax stream were to be segregated, it could serve as the collateral for a municipal bond issuance. The proceeds from such bond issuance could both pay for conversion subsidies and be used to offset the initial tax revenue shortfall.

Affordable housing units will require substantial tax expenditures. But again, relative to the status quo of declining tax revenue from poorly performing offices, the tax revenues from a mixed-use apartment property are still much higher. Lowering the cost of debt for affordable housing projects could help, and there are multiple such programs at both local and federal government levels.

Given the environmental aspects of these conversions, federal resources including the Inflation Reduction Act (IRA) could be a promising route. Passed in 2022, the IRA dedicates $369 billion over 10 years to promote clean energy, pollution reduction, and environmental justice.

While the IRA never explicitly mentions green office conversions, our analysis suggests that there are five provisions in the act that could be relevant. An IRA subsidy can greatly reduce the size of the local property tax abatement needed to realize affordable housing.

Without help from the IRA, apartment conversions risk being either green or affordable, but not both.

Smoothing regulatory barriers to office-to-apartment conversions

Subsidies aside, state and local governments control many of the policy levers that impact the feasibility of office-to-apartment conversions.

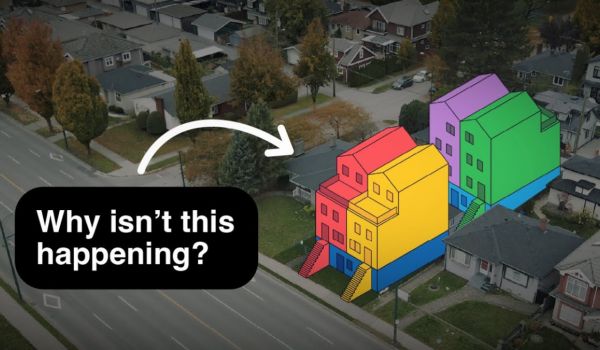

Local governments can and should provide regulatory relief for office conversions by making changes to the zoning resolution, multiple dwelling law, housing and maintenance code and building code. The permitting process should be streamlined to expedite transitions. Local officials should also be empowered to fast-track approvals for conversions.

To bring more buildings into the stock of potential conversions, local governments will need to look at zoning rules and housing code changes. Parts of the central business district may need to be rezoned to allow for residential use.

Even when zoned for residential use, a converted building needs to comply with bulk regulations: restrictions on building height, setback lines and the percentage of open areas. More flexible standards would allow more office buildings in commercial districts to be converted in their entirety for residential use. We suggest going even further to provide additional density bonuses for conversion targets.

Localities may also need to revisit certain building code features, such as the requirements that each bedroom have a window — particularly onerous for conversions of post-World War II office buildings. Or they can simply allow home offices to have a bathroom and closet.

Other zoning changes could eliminate parking space requirements and allow for additional types of residential housing, such as supportive housing, student dormitories and flexible co-living.

Many cities are already reevaluating their zoning rules to make office conversions more feasible and economically viable. Introduced in June 2022, New York City’s “City of Yes” zoning amendments, for example, aim to reach zero carbon emissions, economic opportunity and housing opportunity.

Cities are at a critical crossroads following seismic shifts in how and where we live and work. These shocks present a unique opportunity to reimagine urban spaces for a greener, more sustainable future. Turning offices into greener apartments replaces a falling property tax revenue stream with an increasing one, generating resources for investments that ensure that cities will remain attractive places to live. These office conversions could facilitate urban redevelopment and allow cities to reinvent themselves for a more sustainable future.

This article is part of Backyard, a newsletter exploring scalable solutions to make housing fairer, more affordable and more environmentally sustainable. Subscribe to our weekly Backyard newsletter.

Arpit Gupta is an assistant professor of finance at New York University Stern School of Business. Candy Martinez is a doctoral candidate at Columbia Business School. Stijn Van Nieuwerburgh is a professor of real estate at Columbia Business School.

_600_350_80_s_c1.jpg)

Add to the Discussion

Next City sustaining members can comment on our stories. Keep the discussion going! Join our community of engaged members by donating today.

Already a sustaining member? Login here.